Weather patterns are changing worldwide, and this trend is affecting Canadians directly. Over the last decade, water and flooding have become the most common insurance claim, with floods occurring five times as often as wildfires.

When it comes to protecting your home from water damage, most property owners assume their property insurance policies will provide adequate coverage. This is often not the case.

What Type of Water Damage is Covered by My Homeowner’s Insurance?

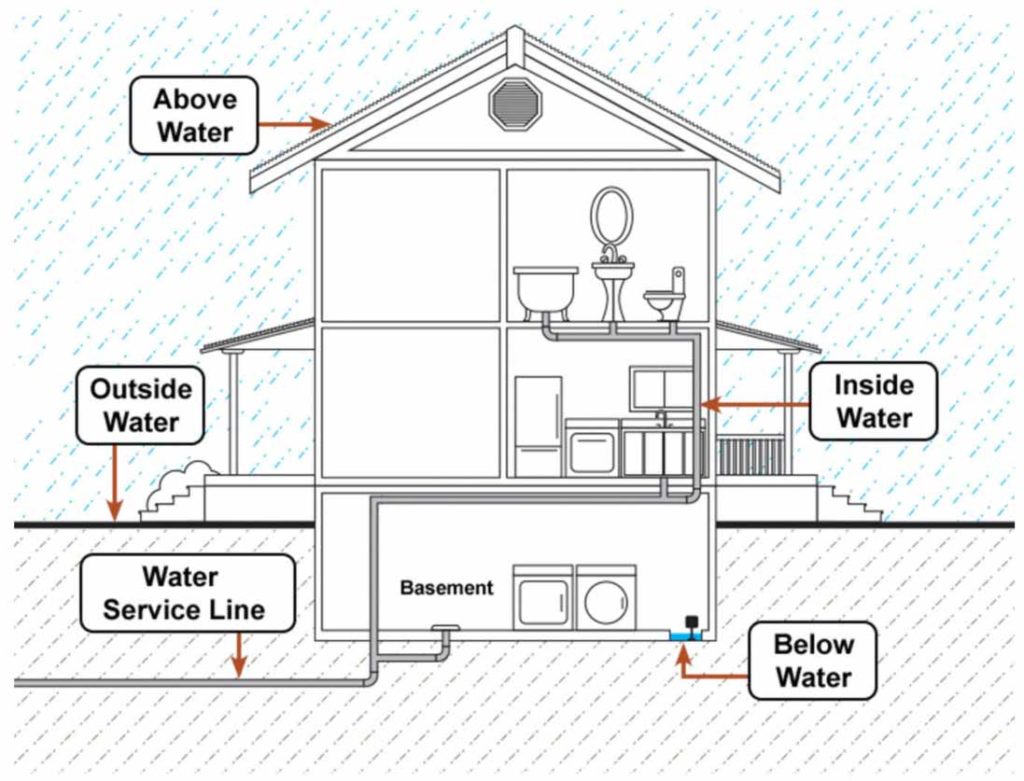

Most homeowner, tenants, or condo insurance will cover many water damage claims that are sudden or accidental under the standard insured perils. Examples of scenarios where the resulting damage may be protected in a comprehensive homeowners policy include:

- Washing machine hose rupturing suddenly (Inside Water)

- Damage from heavy snow or ice buildup (Above Water)

- Damage from steam or a hot water heating system (Inside Water)

- Water entering the home due to wind damage (Above Water)

- Hot water tank bursting (Inside Water)

- Dishwasher line breaking (Inside Water)

Although these types of damages are normally protected under the standard insured perils, care should be taken to review your policy carefully as coverages vary from policy to policy, and from insurer to insurer.

Some insurance providers offer additional options to cover certain types of water damage – sewer backup, overland water coverage, and water service lines coverage. These additional coverage options are explained below.

Additional Types of Water Coverage

Sewer Backup Coverage

Sewer backup-related water damage claims are on the rise in Canada. Severe weather, large rainfalls and sudden downpours are putting extreme stress on our sewage systems, causing them to back up into the home. Sewer backup coverage protects from sudden and accidental backup or escape of water or sewage from within the home through a sewer, septic system or sump pump.

Areas that are prone to flooding, heavy rainfall, and extreme snowmelt are very likely to need sewer backup coverage. Without it, the cost of repairs for a sewer backup could reach the tens of thousands.

Examples of scenarios where the resulting damage may be protected under a Sewer Backup Endorsement include:

- Sump pump failure (Below Water)

- Septic system backup (Below Water)

- Sewer backup due to a clogged line (Below Water)

Overland Water Coverage

Water damage is not always the result of sewer backups. Overland flooding occurs whenever the rising water enters your property through openings in your buildings such as doors, and windows. The occurrence could be a result of heavy rain, spring runoff due to melting snow and ice, or overflow from nearby bodies of water such as a river or stream.

Examples of scenarios where the resulting damage may be protected under an Overland Water Endorsement include:

- Surface water entering the home through a basement window (Outside Water)

- Rain accumulation on the surface of the ground entering through a garage door (Outside Water)

Overland Water enhances the scope of water protection on your policy. Combining both Overland Water and Sewer Backup can provide some of the broadest water protection available at this time.

The definition of overland water coverage, as well as the name, varies from company to company. Be sure to review your policy and check with your broker to see what coverage is available for you in your area.

Ground Water Coverage

Some companies are beginning to offer a new optional water coverage that protects the home from damage caused by water entering suddenly and accidentally through a basement wall, foundation or floor. It is important to remember that this protection is not intended to cover maintenance issues such as long-lasting seepage and leakage.

Examples of scenarios where the resulting damage may be protected under a Ground Water Endorsement include:

- Water entering through a basement floor caused by the rising of the water table

- Water entering through a crack below grade on a basement wall

Water Service Lines Coverage

As your home gets older, so does the water servicing lines that provide water to your property as well as remove wastewater from your property. Leaks and breaks are usually associated with aging pipes, corrosion, extreme temperatures, and settling or shifting of the ground. If the lines fail, repair or replacement can be expensive, and this peril is not normally within the scope of a personal property policy. Water Service Line coverage can provide a specific limit of insurance for costs related to your property including:

- Locating blockages in the pipes

- Costs to expose the damaged pipes

- Pipe replacement and repair

- Unblocking sewer lines

- Backfilling of areas disturbed by repairs

Some insurance companies do not offer Water Service Line coverage, or the definition may vary so be sure to check with your broker to make sure you are protected.

If your property suffers water damage, it is important to understand the type of water causing damage so that your insurance provider can determine if you are covered or not.

Talk to Your Insurance Broker to Learn More

Water damage and coverages can be confusing, so make sure you understand if and how you are protected. In general, coverage is available for owners or tenants of houses, condos, rental properties, seasonal properties or secondary properties. This makes it incredibly flexible, helping individuals secure the right protection.

Even one inch of water could cost you thousands of dollars. The best way to determine your protection is by talking to your insurance broker before a claim occurs. Your broker can tell you what your protection includes and if you should be investing in additional coverage options. To learn more about homeowner’s insurance and the coverage options available, contact Northern Insurance today.

Sources: Insurance Bureau of Canada “Insured Perils” (2019), Zywave Inc., Benefits of Overland Flood Insurance (2018), Home Matters – Protect Your Home from Snowmelt (2018).